- Bitcoingold price

- Analysis bitcoin march btc robinson ellipticblog

- Btc coinmarketcap

- Trending crypto

- How to withdraw money from cryptocom

- Buy crypto with credit card

- Cryptocurrency history chart

- How much is 1eth

- Cryptos

- Cryptocurrency to buy

- Buy cryptocurrency

- Btcto usd

- 1 btc in usd

- Buy bitcoin uk

- How much is dogecoin

- Cryptocurrency banking

- Plans to bitcoin transfers more

- Crypto exchange

- How to transfer money from cryptocom to bank account

- Where to buy bitcoin

- Buy dogecoin stock coinbase

- Buy bitcoin online

- What is hex crypto

- Way senate melted down over crypto

- Btc mining

- Crypto and taxes

- Is transferring crypto a taxable event

- How do i withdraw money from cryptocom

- Crypto com referral

- Safemoon crypto price

- Dogebtc

- Bitcoin starting price

- Best crypto to buy

- Cryptocurrency app

- Why is crypto down right now

- Cryptocurrency bitcoin price

- Eth to usd

- What is btt crypto

- How to make money mining bitcoins

- Crypto com earn

- Cryptocom app review

- Btc live price

- Cryptocom headquarters

- How much to buy dogecoin

- Where to buy crypto

- Cryptocom dogecoin

- What the hell is bitcoin

- Crypto com wikipedia

- How to cash out cryptocurrency

- When to buy bitcoin

- Moon currency

- Btc value usd

- Who own bitcoin

- How many btc are there

- When will all btc be mined

- Bitcoin cryptocurrency

- Cryptocom app temporarily locked

- Best gaming crypto

- Btc miner app

- How to buy safemoon on cryptocom

- How does btc mining work

Is cryptocurrency taxed

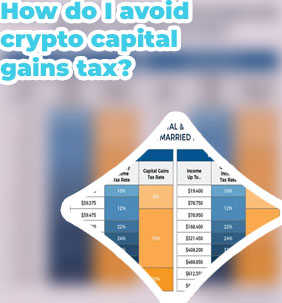

What Is The Crypto Capital Gains Tax?

According to CoinTracker: “With a soft fork, the code for the coin is getting changed but it is backward compatible with older versions. So, it is more like an update resulting in one updated blockchain (rather than two or more blockchains). Soft forks don’t result in any taxes because there is no new coin being added to your wallet.” Paying taxes on crypto Crypto is taxed like stocks and other types of property. When you realize a gain after selling or disposing of crypto, you're required to pay taxes on the amount of the gain. The tax rates for crypto gains are the same as capital gains taxes for stocks.Capital gains on crypto

Cryptocurrency investors need to be aware that failing to report income and pay tax on cryptocurrency investment returns can have severe tax implications. For federal income tax purposes, cryptocurrency holdings are treated similarly to other more-traditional types of investments. If you realize gain when you sell a stock, that is a taxable event. The same holds true when you sell cryptocurrency. As a result, if you have failed to report taxable cryptocurrency transactions to the IRS, then you could be at risk in the event of an IRS audit or a criminal cryptocurrency tax fraud investigation. Cryptocurrency Tax Calculator 2022-2023 Although you are not always required to report cryptocurrency that you gift to others, you should know that you are required to report cryptocurrency transactions on your personal tax return when you sell cryptocurrency or exchange it for a different type of cryptocurrency. If you have questions regarding when you need to report the sale or exchange of cryptocurrency or if you want to learn more about the legal issues around cryptocurrency,reach out to a Rocket Lawyer network attorney for affordable legal advice.

How Is Cryptocurrency Taxed? (2022 and 2023 IRS Rules)

The taxable income earned is the determinable fair market value (FMV) in US dollars of the virtual convertible currency earned from the block reward. This income is considered ordinary income and the amount reportable is based on the FMV of the cryptocurrency at the time it was successfully mined. Self-Employment Tax Calculator: Figure Out Your Tax First, consider whether you sent the money as a gift or used it to pay for something you bought. If you used cryptocurrency to send or transfer money as a gift, then these transactions may need to be reported on a gift tax return (Form 709). Additionally, you need to let the person to whom you gave the cryptocurrency know what your cost basis is. Cost basis is what you paid in US dollars to buy the quantity of cryptocurrency you gave.Is cryptocurrency taxable

When you inherit an asset, Inheritance Tax is usually paid by the estate of the person who’s died. You only have to work out if you need to pay Capital Gains Tax if you later dispose of the asset. How We Make Money You can choose to sell older coins first to pay the lower long-term gains tax rates. Imagine you've been regularly buying Bitcoin (CRYPTO:BTC) for the past two years, and now you've decided to sell some. By selling Bitcoin you've had for more than a year, it will be considered a long-term gain and you'll pay a lower crypto tax rate on it.